The 6-Minute Rule for Custom Private Equity Asset Managers

Wiki Article

Rumored Buzz on Custom Private Equity Asset Managers

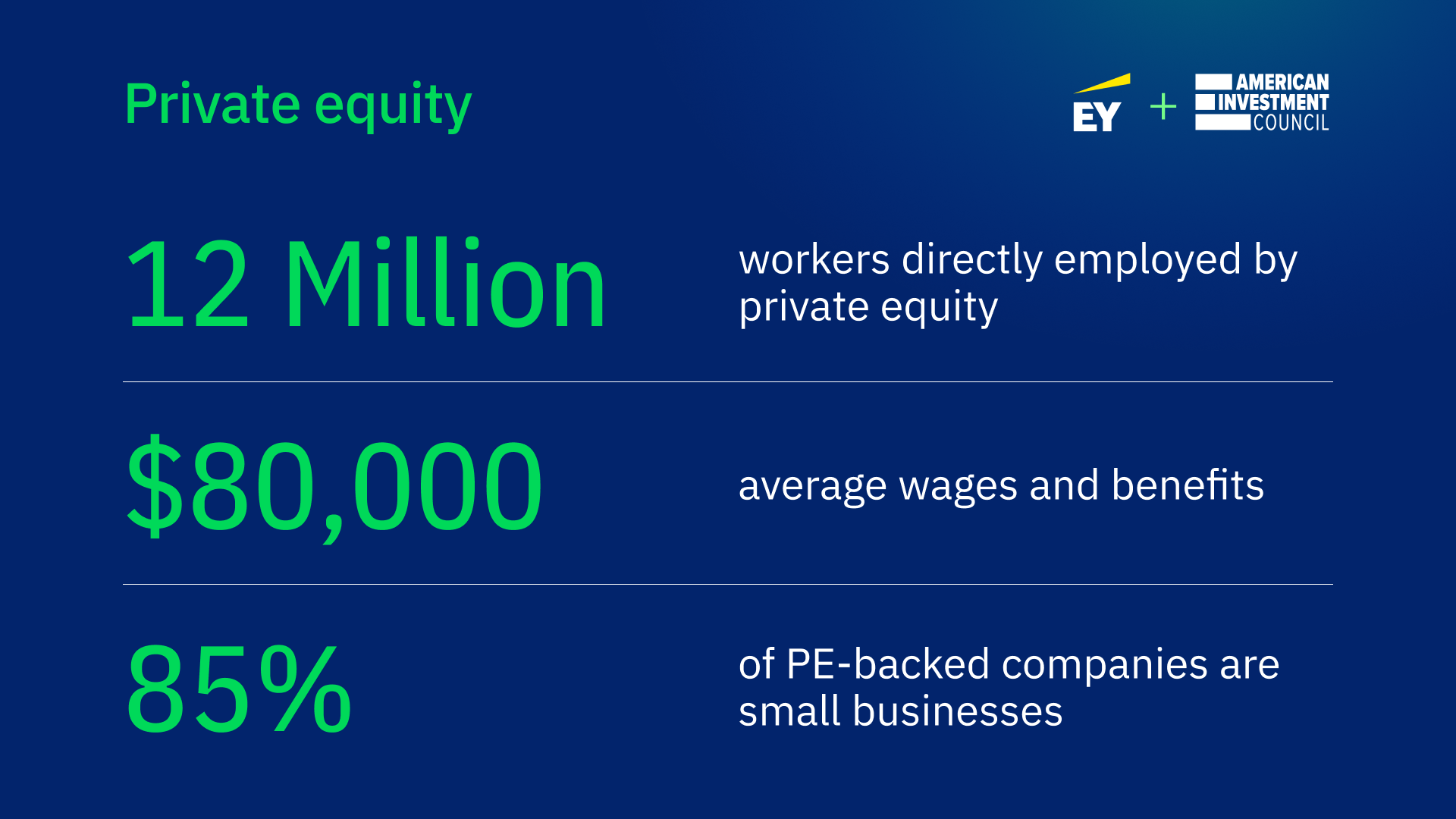

You have actually probably heard of the term personal equity (PE): buying firms that are not publicly traded. About $11. 7 trillion in properties were taken care of by private markets in 2022. PE companies seek opportunities to gain returns that are much better than what can be attained in public equity markets. There might be a few points you do not recognize about the industry.

Private equity companies have an array of investment choices.

Due to the fact that the very best gravitate toward the larger offers, the middle market is a considerably underserved market. There are much more vendors than there are highly experienced and well-positioned money experts with comprehensive purchaser networks and sources to take care of a bargain. The returns of personal equity are typically seen after a couple of years.

Custom Private Equity Asset Managers Things To Know Before You Buy

Flying below the radar of huge international companies, a lot of these tiny firms typically offer higher-quality customer care and/or specific niche products and services that are not being offered by the large conglomerates (https://www.twitch.tv/cpequityamtx/about). Such upsides attract the interest of exclusive equity companies, as they have the insights and savvy to make use of such opportunities and take the firm to the next level

Many supervisors at portfolio firms are given equity and reward settlement structures that award them for striking their economic targets. Personal equity possibilities are commonly out of reach for people that can not spend millions of bucks, but they shouldn't be.

There are regulations, such as limits on the accumulation amount of money and on the variety of non-accredited investors. The exclusive equity organization draws in a few of the most effective and brightest in company America, including top entertainers from Fortune 500 business and elite management consulting firms. Legislation companies can additionally be hiring premises for personal equity hires, as audit and lawful abilities are required to total offers, and purchases are extremely searched for. https://penzu.com/p/4b84c99dc492ccef.

Getting The Custom Private Equity Asset Managers To Work

Another disadvantage is the lack of liquidity; as soon as in a personal equity transaction, it is not simple to leave or sell. There is an absence of adaptability. Private equity also features high fees. With funds under management currently in the trillions, private equity companies have become eye-catching financial investment lorries for rich people and institutions.

click here to readNow that access to personal equity is opening up to more individual investors, the untapped capacity is becoming a truth. We'll begin with the primary debates for spending in personal equity: Exactly how and why exclusive equity returns have actually historically been greater than various other properties on a number of degrees, Just how consisting of private equity in a portfolio influences the risk-return account, by aiding to expand versus market and intermittent risk, Then, we will certainly outline some key considerations and risks for private equity investors.

When it concerns introducing a new asset right into a profile, one of the most basic consideration is the risk-return profile of that possession. Historically, personal equity has shown returns comparable to that of Arising Market Equities and more than all other typical property classes. Its relatively low volatility paired with its high returns produces a compelling risk-return account.

9 Easy Facts About Custom Private Equity Asset Managers Shown

Actually, personal equity fund quartiles have the best range of returns throughout all alternate property classes - as you can see below. Methodology: Inner rate of return (IRR) spreads computed for funds within vintage years individually and after that balanced out. Average IRR was computed bytaking the standard of the median IRR for funds within each vintage year.

The takeaway is that fund selection is crucial. At Moonfare, we perform a rigid choice and due diligence procedure for all funds listed on the system. The result of adding exclusive equity right into a portfolio is - as always - depending on the profile itself. However, a Pantheon research from 2015 suggested that including exclusive equity in a portfolio of pure public equity can open 3.

On the other hand, the finest exclusive equity firms have access to an even larger swimming pool of unidentified possibilities that do not deal with the exact same examination, in addition to the resources to execute due diligence on them and recognize which deserve buying (Private Equity Firm in Texas). Spending at the very beginning means higher danger, but for the firms that do prosper, the fund advantages from higher returns

The Ultimate Guide To Custom Private Equity Asset Managers

Both public and private equity fund supervisors devote to spending a percentage of the fund but there continues to be a well-trodden problem with lining up rate of interests for public equity fund monitoring: the 'principal-agent trouble'. When a financier (the 'primary') hires a public fund manager to take control of their resources (as an 'agent') they pass on control to the manager while retaining possession of the assets.

When it comes to personal equity, the General Companion doesn't simply earn a monitoring cost. They also gain a percentage of the fund's earnings in the form of "lug" (normally 20%). This makes certain that the passions of the supervisor are lined up with those of the capitalists. Personal equity funds also alleviate an additional form of principal-agent issue.

A public equity capitalist eventually desires one point - for the administration to enhance the stock cost and/or pay out rewards. The capitalist has little to no control over the decision. We showed over the amount of exclusive equity strategies - specifically majority acquistions - take control of the operating of the business, making sure that the long-lasting value of the firm precedes, raising the roi over the life of the fund.

Report this wiki page